WHAT IS CORPORATE TAX?

Corporate Tax is a form of direct tax levied on the net income or profit of corporations

and other businesses. Corporate Tax is sometimes also referred to as <Corporate Income

Tax= or <Business Profits Tax= in other jurisdictions.

WHEN WILL THE UAE CT REGIME BECOME EFFECTIVE?

The UAE CT regime will become effective for financial years starting on or after 1 June 2023

Examples:

A business that has a financial year starting on 1 July 2023 and ending on 30 June 2024 will

become subject to UAE CT from 1 July 2023 (which is the beginning of the first financial

year that starts on or after 1 June 2023)

A business that has a (calendar year) financial year starting on 1 January 2023 and

ending on 31 December 2023 will become subject to UAE CT from 1 January 2024

(which is the beginning of the first financial year that starts on or after 1 June

2023)

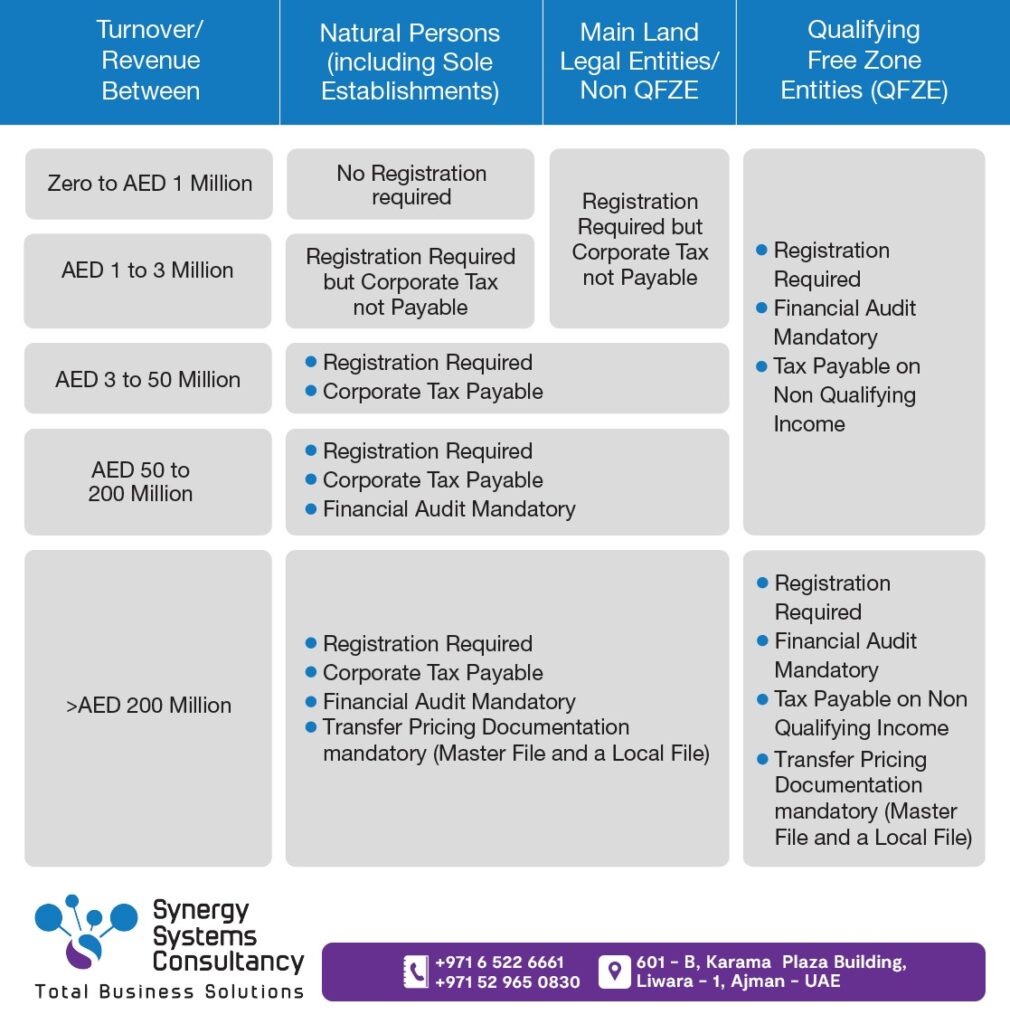

WHAT WILL THE UAE CT RATES BE?

The CT rates are:

0% for taxable income up to AED 375,000;

9% for taxable income above AED 375,000;

And,

a different tax rate for large multinationals that meet specific criteria set with reference to

'Pillar Two' of the OECD Base Erosion and Profit Shifting project

- Bookkeeping services

- Accounting & Finalization Services

- Payroll services

- Financial advisory

- ERP systems solutions