Synergy's Blog Insights

- 07/06/2023

THIS IS OUR PROMISE TO YOU

3 Great benefits of outsourcing accounting and payroll activities. Saving time on processing: By outsourcing accounting and payroll tasks, you may gain more time and focus on adding value to revenue-generating operations while having the peace of mind that it...

- 06/06/2023

Our experts will take care of you

You can't fly the aircraft of your airline business. You can't work on the vehicles in your auto repair shop. You can't cut the grass in your landscaping business. Why? Delegating such tasks to highly skilled persons in that field is the finest move...

- 02/06/2023

Voluntary Disclosure

When submitting a Voluntary Disclosure for VAT returns, what information you must provide? Your personal information, such as;Your namePhone numberAddressAnd the VAT return period for which you are filing a Voluntary Disclosure, *will be pre-filled* in their respective boxes. You must provideThe...

- 02/06/2023

How long do VAT records need to be kept?

How long do VAT records need to be kept?Businessowners should keep their records and books of accounts for at least 5 years after the fiscal year in which they operate ends. The business owner, shareholders, or partners should confirm that...

- 02/06/2023

VAT on expenses incurred

Can businesses claim VAT on expenses incurred?VAT can be claimed by businesses in the following situations: If the company is VAT registered, they can claim a refund on expenses (the end consumer cannot claim any input tax refund).VAT must be correctly...

- 02/06/2023

What exactly is the reverse charge?

What exactly is the reverse charge? The conventional method of collecting VAT requires the seller of supplies or services to collect VAT from buyers and remit it to the FTA. The responsibility for reporting VAT is transferred from the seller...

- 02/06/2023

VAT’s Impact on UAE Free

There has been a lot of discussion about free zones and designated zones since the implementation of VAT. The Ministry of Finance has clarified some details about these zones and announced the establishment of twenty designated zones across the country. The...

- 02/06/2023

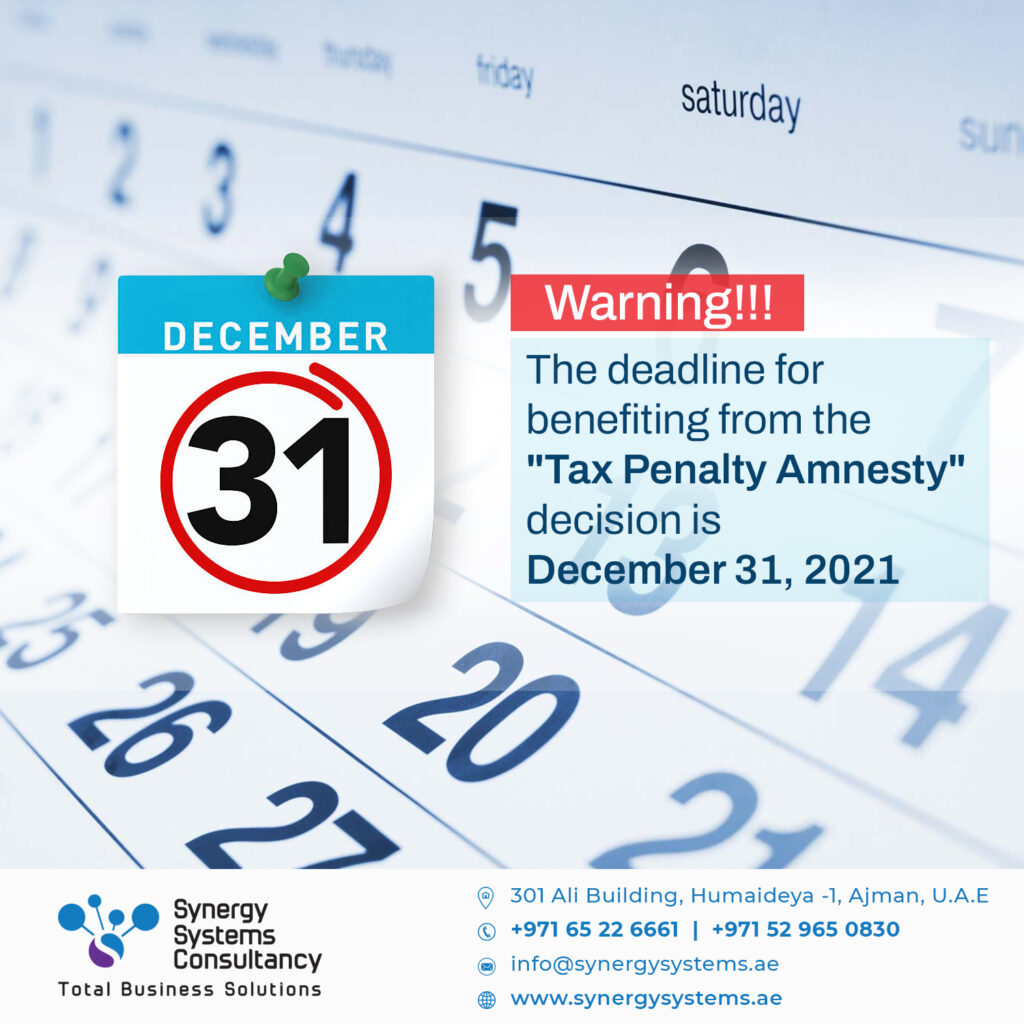

Assist registrants in meeting their tax obligations

This is intended to assist registrants in meeting their tax obligations. • The Decision has been in force since June 28, 2021. • The decision lowers several administrative penalties for tax law violations after June 28, 2021. ...

- 02/06/2023

Excise Tax required in your business?

Excise Tax required in your business? Here's how you can find out. According to UAE Federal Decree Law No. 7 of 2017 on Excise Tax, it is the responsibility of any business engaged in the following activities to register for...

- 31/05/2023

Freelancer Free From Vat ?

Hello Freelancers! Here's all you need to know about VAT registration in the UAE. It is the age of creators, and the UAE government has taken significant initiatives in recent years to improve and simplify the work environment for freelancers...

- 31/05/2023

RECORD-KEEPING

WHAT YOU MUST KNOW ABOUT RECORD-KEEPING OF CUSTOMER IDENTITY AND TRANSACTIONS? According to Article 24 of Cabinet Decision No. (10) of 2019, Financial Institutions (FI) and Designated Non-Finance Businesses & Professions (DNFBPs) must keep proper records to ensure compliance with...